does binance send tax forms

If you receive a crypto income of more than 600 BinanceUS will send Form 1099-MISC to report your taxes. Do We Need to Report Binance Trading on FBAR.

How To Buy Binance Coin Forbes Advisor

Does Binance Send Tax Forms Canada.

. Click on Create Tax Report API. Yes BinanceUS sends Forms 1099-MISC to traders who have earned more than 600 on the platform from staking and rewards. If you earned at least 600 through staking or Learn and Earn rewards BinanceUS issues 1099-MISC s and reports to the IRS.

Does Binance Work In Canada A Federal Government. It operates in canada but not in ontario. Upload your CSV or XLSX files here.

Taxpayers to answer yes or no to whether they had any crypto. In 2019 the IRS introduced a mandatory check box on Form 1040 US. No Binance US doesnt provide a tax report.

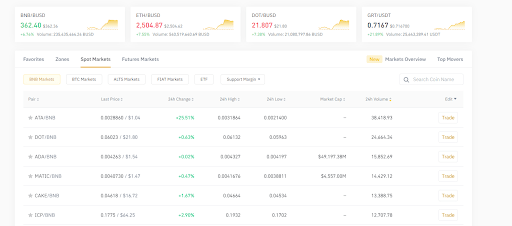

These kinds of incomes are classified. How To Get Tax Info From Binance. We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes.

BinanceUS will use Sovos technology to automate its 1099 forms and filings which helps reduce potential human errors and ensure automatic regulatory updates. Accounting services are there for service and Binance is a Third Party Settlement Organization. Does Binance US issue 1099 forms.

On the left sidebar click add transactions. Click on Export Complete Trade History at the top right corner. We have integrated binance.

That doesnt mean Binance does it on purpose. Binance us tax forms Binance us tax forms reddit 4. Go to the Binance API page by hovering over the user icon in the top header and then click API Management.

Although it previously issued certain traders. Binance allows exporting trades for a 3. Click Get code to receive a.

The biggest implication is that Binance will share wallet information and trading data with the IRS which could trigger primal investigations and civil audits. Does Binance Send Tax Forms Canada. Mining staking crypto or receiving an.

However Binance US does issue 1099-MISC forms to some users. Does Binance US provide a tax report. Does Binance Send Tax Forms Canada By law the exchange needs to keep extensive records of every transaction that takes place on the platform.

Receiving crypto as income 5. As such the exchange will provide you with a detailed list of everything you need to submit a legal tax return form including transaction history but. While Binance US might not be sending out 1099-K forms the IRS is taking a hard stance on crypto tax evasion.

It operates in canada but not in ontario. When a customer earns more than 600 through staking referrals and other income-generating activities BinanceUS issues a Form 1099-MISC and files an identical copy with the IRS. Does Binance Work In Canada A Federal Government.

Yes Binance does provide tax info but you need to understand what this entails. By law the exchange needs to keep extensive records of every transaction that takes place on. They can request your data from any larger crypto exchange.

So the exchange will provide you with a. This form is used to. On the left sidebar click add transactions.

Individual Income Tax Return requiring US.

Kraken Vs Binance Forbes Advisor

Does Binance Us Report To The Irs

Binance Tax Reporting Instant Tax Forms Cryptotrader Tax Demo Youtube

The Basics Of Taxes On Crypto Tax Pro Center Intuit

Cryptocurrency Taxation Here S What You Need To Know Cnn Business

Binance Tax Calculator How To Do Your Binance Taxes In 2022

Binance Tax Reporting How To Do It Ultimate Guide By Cryptogeek

.jpg)

Does Binance Report To The Irs Coinledger

How To Do Your Binance Us Taxes Koinly

How Long Does It Take To Get Verified On Binance

Does Binance Us Report To The Irs

How To Send Coins Btc Eth Ada Etc From Binance To Uphold

Binance Tax Reporting How To Do It Ultimate Guide By Cryptogeek

How To Complete Identity Verification Binance

How To Do Your Binance Us Taxes Koinly

How The Irs Knows You Owe Crypto Bitcoin Taxes Cointracker